Missing Account Information on Bravo Reports

Find out how to receive and why there is missing account information (Address, Phone Number and Email) on a Bravo report

For a detailed breakdown of financial institutions and the percentage of reports that do not return an address or phone number, please scroll to the bottom of this article.

If the Account Information is not displayed in the top right-hand corner of a TurboPass Report, you can try rebuilding the report. (See how here)

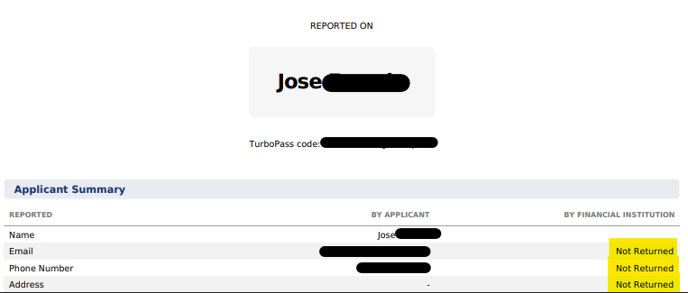

If rebuilding the report does not help, most of the time, in the final steps of linking to TurboPass, the customer is presented with boxes to check off. Please view the example below:

Make sure the customer has checked all boxes off before clicking continue. The boxes include the accounts they want to share along with the account information like address, phone number and email.

Wells Fargo Accounts Not Returning Phone Number

If you have a TurboPass report on a Wells Fargo account that does not have a phone number, please have the customer log in to their account on a desktop, go to 'My Profile', then 'Update Contact Information'. Under the 'Phone numbers' section enter their cell phone number under the 'Work' Phone section as seen below

After this has been saved, rebuild the TurboPass report or send the customer another invitation to link their account again. This will successfully return a phone number on the TurboPass report.

If that also doesn't resolve the issue, it is likely due to a setting in the consumer's online bank account that restricts third party access to certain information. This setting is generally known as "third party access restriction" and is designed to protect the user's privacy and prevent unauthorized access to their account. When this setting is enabled, it prevents external services like TurboPass from retrieving account information.

In this case, you can advise the customer to navigate to their account settings and look for settings related to this issue. These settings are usually located in the Privacy Preferences, Security Settings, or Privacy Setting sections of their online banking platform. By accessing these settings, the customer can review and modify their privacy preferences to allow third party access to the necessary account information.

To enable third party access, the customer may need to toggle a switch, update their privacy settings, or grant specific permissions. It's important to note that the exact location and wording of these settings may vary depending on the bank's online platform.

Once the necessary changes have been made, send the invitation to the customer again to regenerate the TurboPass Report and verify if the account information is now displayed correctly in the top right-hand corner.

Keep in mind that if a financial institution has a 0% chance of returning an address or phone number, it's likely due to the institution's restrictions in sharing data with third parties.

Financial Institution |

% of Reports with an Address |

| BMO (US) | 0.00% |

| Branch | 0.00% |

| Cadence Bank - Retail | 0.00% |

| Capital One | 0.00% |

| Frost Bank | 0.00% |

| Global Credit Union | 0.00% |

| Ocean Bank (FL) | 0.00% |

| ONE | 0.00% |

| Seis | 0.00% |

| SoFi | 0.00% |

| Uber Pro Card | 0.00% |

| Santander - Personal | 2.50% |

| Golden 1 Credit Union | 19.87% |

| Fifth Third Bank | 71.19% |

| Prosperity Bank | 75.38% |

| First National Bank of Omaha - Online Banking | 77.66% |

| Citizens Bank | 82.66% |

| PNC | 87.21% |

| FirstBank (Colorado) - Personal Online Banking | 93.04% |

| Venmo - Personal | 94.10% |

| Woodforest National Bank | 94.49% |

| Bank of America | 95.47% |

| Regions Bank | 95.79% |

| Huntington Bank | 96.82% |

| Desert Financial Credit Union | 96.90% |

| Wells Fargo | 97.30% |

| GECU | 97.53% |

| Truist | 97.64% |

| BankMobile VIBE | 98.08% |

| Old National Bank | 98.25% |

| Green Dot Prepaid Debit Card | 98.32% |

| First National Bank Texas & First Convenience Bank | 98.34% |

| Atlantic Union Bank - Personal Online Banking | 98.40% |

| Boeing Employees Credit Union (BECU) - Personal Online Banking | 98.46% |

| IBC Bank | 98.68% |

| OnPoint Community Credit Union | 98.87% |

| Ally Bank | 99.13% |

| SAFE Credit Union (CA) | 99.21% |

| America First Credit Union | 99.35% |

| VyStar Credit Union | 99.36% |

| Citibank Online | 99.67% |

| Discover | 99.69% |

| M&T Bank | 99.71% |

| State Employees' Credit Union (NC) | 99.72% |

| Chase | 99.77% |

| U.S. Bank | 99.78% |

| USAA | 99.82% |

| Suncoast Credit Union | 99.85% |

| Mountain America Credit Union | 99.85% |

| Navy Federal Credit Union | 99.95% |

| TD Bank | 99.98% |

| ACE Flare Account by Metabank | 100.00% |

| Altura Credit Union | 100.00% |

| Arrowhead Credit Union | 100.00% |

| Arvest Bank - Online Banking | 100.00% |

| Chime | 100.00% |

| Credit Karma | 100.00% |

| Current | 100.00% |

| Dade County Federal Credit Union | 100.00% |

| Dave | 100.00% |

| Delta Community Credit Union | 100.00% |

| Digital Federal Credit Union | 100.00% |

| Ent Credit Union | 100.00% |

| FAIRWINDS Credit Union | 100.00% |

| First Citizens Bank - Digital Banking | 100.00% |

| First Financial Bank | 100.00% |

| First Horizon Bank - Digital Banking | 100.00% |

| First United Bank | 100.00% |

| Found | 100.00% |

| GO2bank | 100.00% |

| Idaho Central Credit Union | 100.00% |

| KeyBank | 100.00% |

| MIDFLORIDA Credit Union | 100.00% |

| Netspend All-Access Account by MetaBank | 100.00% |

| Nusenda Credit Union | 100.00% |

| PayPal | 100.00% |

| Randolph Brooks Federal Credit Union | 100.00% |

| Redwood Credit Union - Digital Banking | 100.00% |

| Rockland Trust | 100.00% |

| Schools First FCU | 100.00% |

| Skylight ONE - SkylightOne | 100.00% |

| South State Bank - Online Banking | 100.00% |

| SouthState Bank - Online Banking | 100.00% |

| Space Coast Credit Union | 100.00% |

| Square | 100.00% |

| Synovus - Personal | 100.00% |

| United Bank - Personal & Small Business | 100.00% |

| Varo Bank | 100.00% |

| Walmart MoneyCard by Green Dot | 100.00% |

| Wisely | 100.00% |

Financial Institution |

% of Reports with Phone Number |

| Branch | 0.00% |

| Capital One | 0.00% |

| Ent Credit Union | 0.00% |

| Frost Bank | 0.00% |

| Global Credit Union | 0.00% |

| ONE | 0.00% |

| Seis | 0.00% |

| SoFi | 0.00% |

| Uber Pro Card | 0.00% |

| Golden 1 Credit Union | 20.53% |

| PNC | 25.48% |

| First National Bank of Omaha - Online Banking | 36.70% |

| Wells Fargo | 41.23% |

| USAA | 51.39% |

| Woodforest National Bank | 63.46% |

| Cadence Bank - Retail | 70.75% |

| Fifth Third Bank | 71.19% |

| Prosperity Bank | 75.88% |

| Square | 77.09% |

| M&T Bank | 78.19% |

| Skylight ONE - SkylightOne | 79.25% |

| Citizens Bank | 82.05% |

| SAFE Credit Union (CA) | 88.19% |

| FirstBank (Colorado) - Personal Online Banking | 92.83% |

| Nusenda Credit Union | 93.55% |

| First National Bank Texas & First Convenience Bank | 93.74% |

| Bank of America | 93.77% |

| Netspend All-Access Account by MetaBank | 94.01% |

| Venmo - Personal | 94.10% |

| Atlantic Union Bank - Personal Online Banking | 94.40% |

| Boeing Employees Credit Union (BECU) - Personal Online Banking | 94.87% |

| First Citizens Bank - Digital Banking | 94.89% |

| Huntington Bank | 96.74% |

| Desert Financial Credit Union | 96.90% |

| SouthState Bank - Online Banking | 96.94% |

| BMO (US) | 97.11% |

| GECU | 97.22% |

| Redwood Credit Union - Digital Banking | 97.50% |

| First Financial Bank | 98.05% |

| BankMobile VIBE | 98.08% |

| Truist | 98.19% |

| Old National Bank | 98.25% |

| Green Dot Prepaid Debit Card | 98.32% |

| Ocean Bank (FL) | 98.51% |

| Regions Bank | 98.54% |

| Delta Community Credit Union | 98.65% |

| IBC Bank | 98.68% |

| Wisely | 98.76% |

| OnPoint Community Credit Union | 98.87% |

| Santander - Personal | 99.02% |

| First United Bank | 99.10% |

| Ally Bank | 99.13% |

| America First Credit Union | 99.35% |

| VyStar Credit Union | 99.36% |

| U.S. Bank | 99.45% |

| MIDFLORIDA Credit Union | 99.46% |

| Chase | 99.66% |

| Citibank Online | 99.67% |

| Discover | 99.69% |

| State Employees' Credit Union (NC) | 99.72% |

| Navy Federal Credit Union | 99.77% |

| TD Bank | 99.79% |

| Mountain America Credit Union | 99.85% |

| PayPal | 99.88% |

| Suncoast Credit Union | 99.93% |

| ACE Flare Account by Metabank | 100.00% |

| Altura Credit Union | 100.00% |

| Arrowhead Credit Union | 100.00% |

| Arvest Bank - Online Banking | 100.00% |

| Chime | 100.00% |

| Credit Karma | 100.00% |

| Current | 100.00% |

| Dade County Federal Credit Union | 100.00% |

| Dave | 100.00% |

| Digital Federal Credit Union | 100.00% |

| FAIRWINDS Credit Union | 100.00% |

| First Horizon Bank - Digital Banking | 100.00% |

| Found | 100.00% |

| GO2bank | 100.00% |

| Idaho Central Credit Union | 100.00% |

| KeyBank | 100.00% |

| Randolph Brooks Federal Credit Union | 100.00% |

| Rockland Trust | 100.00% |

| Schools First FCU | 100.00% |

| South State Bank - Online Banking | 100.00% |

| Space Coast Credit Union | 100.00% |

| Synovus - Personal | 100.00% |

| United Bank - Personal & Small Business | 100.00% |

| Varo Bank | 100.00% |

| Walmart MoneyCard by Green Dot | 100.00% |

| Grand Total | 100.00% |

The data presented was gathered in 2024. It is important to note that some of the percentages may have changed over time due to integrations and connections with specific financial institutions.